Analyst relations (AR) and public relations are usually closely paired within the marketing functions of today’s businesses. At Catapult, we run AR programs for most of our clients, in addition to PR. This makes sense because in some ways, analysts function like journalists—although more technical, specialized and usually with prior firsthand industry experience. Analysts formally report on the movements they see within particular markets. They evaluate and review vendors, provide recommendations and forecast future growth of markets.

Our clients take a number of different approaches and attitudes toward AR and some are surprised to learn that handling analyst relations properly can dramatically increase company sales and overall positioning. There are differing opinions in the high-tech B2B industry as to how influential analysts actually are on buying decisions and differing opinions on how important investing in analyst relations is. I’ve known and worked for companies that don’t “believe in” analyst relations, yet spend hundreds of thousands of dollars per year with large firms like Gartner and Forrester simply because “that’s the way it is.”

If your company is spending any money at all on AR, it’s important to evaluate the philosophies and motives that will drive that AR program. Typically, B2B companies with an investment in AR tend to fall in one of two camps when it comes to their mindset regarding analysts:

- The Analysts Drive Me (Industry analysts are the experts, they tell me what to do and I do it, they tell me whether my products make the cut or not, and I use their feedback regularly to steer my company and improve my products. Analysts educate me.)

Or

- I Drive the Analysts (Industry analysts are a mouthpiece for my company and products. I regularly influence analysts’ agendas and perceptions and use them to help move the market in my direction. I educate analysts.)

While number two is certainly preferable to number one, the reality is, a company cannot succeed by taking 100 percent one stance or the other. In the first case, “The analysts drive me,” leadership fails to consider that analysts spend much of their time talking with competitors and other vendors who may have a more aggressive, number two-style approach. So when an analyst gives opinions on trends or forecasts, these views may have been part of a competitor’s agenda.

Also, while analysts certainly have a wide network of both vendors and end-users as resources, they can sometimes be limited in their scope of research to companies that subscribe to their particular firm’s services—meaning the analysts may not always have exposure to the entire market. Any executive team that takes the guidance of analysts as if it were the ‘word of god,’ is setting the company up for failure and missing opportunities for influence. While analysts are incredibly knowledgeable, they are only human and can’t be the end all be all. In fact, most good analysts welcome learning opportunities and appreciate the insights vendors have to offer on markets, trends, etc.

As for the second mindset, “I drive the analysts,” this approach can start to fall flat if a company ignores analyst feedback or criticism. I knew a CEO who took a very cynical approach to AR and repeatedly dismissed cautioning and even outright criticism from analysts because of his view that analysts were merely puppets for the vendors. This led to tense relationships between himself and influential analysts and ultimately a lack of positive coverage or coverage at all. Not the best route.

No doubt, organizations should have well-planned strategies for educating and influencing analysts, but they also need to understand that analysts have much to offer vendors. Analysts spend a portion of their time talking to end-users and buyers. This means, yes, it is very important to take a proactive stance, but it is also very important to listen. Vendors shouldn’t be afraid to ask analysts about the kinds of conversations they are having with end-users and find out what industries correspond with which needs, etc. While analysts have to respect NDAs and may not be able to share everything, they can offer valuable insight.

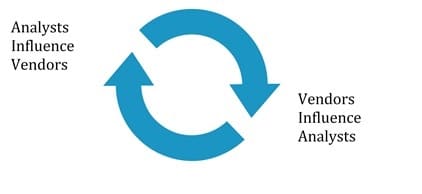

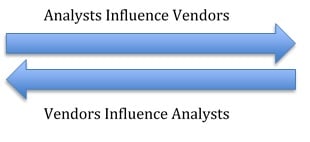

In reality, the relationship between analysts and vendors looks more like a cycle or a two-way street:

A balanced AR program reaps benefits from both sides of the street. B2B companies can learn and grow through analyst relationships, while also expanding their sphere of influence to include analysts and those analysts’ constituents—turning analysts into advocates, if not for the company than for the strategic narrative or category created by the company.

Walking forward with this balance might be tricky for companies who are new to the idea of AR and want to understand it’s full potential. PR firms are helpful because they can provide best practices around things such as:

- Which analysts to brief and when.

- How to prepare for and deliver a briefing.

- The difference between briefings, inquiries and how to use them for strategic purposes.

- How to prioritize certain analysts over others and why.

- Ways to put the best foot forward when filling out report questionnaires and conducting demos.

- How to respond to negative analyst coverage.

- Other tips and tricks from years of experience on generating more positive analyst coverage.

- Much more!

AR is a complex business function and requires much more planning and strategy than most executives realize. The philosophy behind a company’s approach to AR will greatly impact analyst interactions and, as a result, analyst coverage. It’s important for B2B companies to understand that AR is a two-way street and work to develop ways to both learn from analysts as well as influence their research in favor of the company.